What are Dave Ramsey’s 37 Steps?

Postado 2022-08-30 10:36:14

0

72

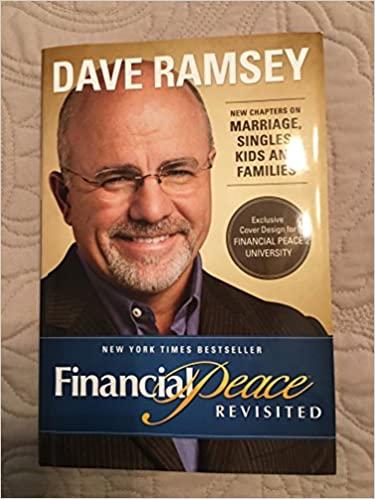

37 key sub-headings are spread out through the 22 chapters of the book Financial Peace are as follows:

- Avoid “Stuffitis” the Worship of “Stuff”

- Plant Seeds—Give Money Away to Worthy Causes

- Develop Your Own “Power Over Purchase”

- Find Where You Are Naturally Gifted — Enjoy Your Work and Work Hard

- Live Substantially Below Your Income

- Sacrifice Now So You Can Have Peace Later

- You Can Always Spend More Than You Can Make

- The Borrower Is the Servant to the Lender; So Beware!

- Check Your Credit Report at Least Once Every Two Years

- Handle Credit Report Corrections Yourself

- Realize That the Best Way for Delinquent Debt to Be Paid Is for You, Not Collectors, To Control Your Financial Destiny

- You Must Save Money (The Power of Compound Interest)

- Use the “Keep It Simple, Stupid” Rule of Investing

- Only People Who Like Dog Food Don’t Save for Retirement

- Always Save With Pretax Dollars It Is the Best Deal The Government Gives You

- Learn Basic Negotiating Skills for Great Buys

- Learn Where to Find Great Buys (the Treasure Hunt)

- You Must Have Patience to Get Great Buys

- Singles Get Self-Accountability From the Written Plan

- Singles Should Look For a Money Mentor for Advice And Accountability

- Singles Beware of the Impulse Monster; He Will Eat You Alive

- Men and Women View Money Differently, so Be Sensitive To Differences

- Opposites Attract in Marriage, So Work Together For Maximum Wisdom

- When You Agree on Spending, You Will Experience Fabulous Unity in Your Marriage

- Teach Children to Work, Spend Wisely, Save, And Give

- The Most Powerful Legacy You Can Leave Is Wise, Competent Children

- Giving Loved Ones All the Money They Request May Not Be Best for Them

- Making Decisions Based on Fear of Reprisal Can Be a Sign of Codependence

- Be Strong Enough to Help Others and Strong Enough Not To

- Listen to Your Spouse’s Counsel (Women’s Intuition)

- There Are Few “Old” Fools—Seek Experienced Counsel

- You Must Keep Your Checkbook on a Timely Basis

- Lay Out the Written Details of a Cash Management Plan

- Commit to Your Plan for Ninety Days

- Take Time to Prioritize Your Life Daily

- Keep Your Spiritual Life Healthy

- Take Baby Steps — Prioritize Your Plan and Move Slowly

Pesquisar

Categorias

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

Leia mais

Minimally Invasive and Non-Invasive Medical Imaging and Visualization Systems Market Challenges: Growth, Share, Value, Trends, and Analysis

"Executive Summary Minimally Invasive and Non-Invasive Medical Imaging and Visualization...

テトラリン産業レポート:世界市場シェア、競合分析、予測2025-2031

2025年6月11日に、YH Research株式会社(本社:東京都中央区)は、調査レポート「グローバルテトラリンのトップ会社の市場シェアおよびランキング...

Asia-Pacific Anti-Friction Coatings Market Size, Share, Trends, Growth and Competitive Analysis

"Executive Summary Asia-Pacific Anti-Friction Coatings Market :

Anti-Friction...

Forecasting Growth and Market Landscape of the E-Bike Industry (2025–2033) | UnivDatos

A comprehensive overview of the Global E-Bike Market is recently added by UnivDatos, to its...

固定速度スクロールコンプレッサー市場規模予測:2031年には5513百万米ドルに到達へ

2025年6月13日に、QYResearch株式会社は「固定速度スクロールコンプレッサー―グローバル市場シェアとランキング、全体の売上と需要予測、2025~2031」の調査レポートを発表しました...

© 2025 Omaada - A global social and professionals networking platform

Portuguese (Brazil)

Portuguese (Brazil)