From Commuters to Couriers: Growth Trajectories in the E-Bike Market

The global electric bicycle market has evolved from a niche premium product to a mainstream mobility solution that spans commuting, delivery logistics, leisure, and sport. E-bicycles combine human pedaling with an electric motor and battery system to deliver assisted propulsion, enabling longer trips, easier hill climbs, and wider user demographics. These qualities—alongside growing urbanization, congestion, air-quality concerns, and a push for low-carbon transport—are positioning e-bikes as a core component of sustainable urban mobility systems through 2032.

Market Overview

E-bicycles comprise several product classes: pedal-assist (pedelecs), throttle-on-demand models, cargo and utility e-bikes, folding and last-mile commuters, and performance e-mountain bikes. Key components include motors (hub vs. mid-drive), lithium-ion battery packs, battery management systems, controllers, human-machine interfaces, and connected electronics for navigation and fleet management.

Market development is characterized by rapid product diversification, falling component costs, improvements in battery energy density, and integration of smart features (GPS, IoT connectivity, app pairing). Adoption models vary: personal ownership, subscription and rental services, and commercial fleets for courier and food delivery services. Public policy, infrastructure (bike lanes, charging hubs), and urban planning are deeply influential in shaping uptake.

Click here to download a sample report

Key Market Drivers

- Urbanization and Congestion Mitigation

E-bikes offer a space-efficient, agile alternative to cars for short-to-medium urban trips, easing congestion and parking pressure. - Sustainability and Emissions Reduction Goals

Cities and companies favor low-carbon solutions; e-bikes reduce tailpipe emissions and lifecycle energy intensity relative to cars and vans for many trips. - Micromobility & Last-Mile Logistics Growth

Rising e-commerce and on-demand deliveries have driven the adoption of cargo e-bikes and e-cargo trikes in dense urban environments. - Improved Battery and Motor Technology

Advances in energy density, fast-charging, and motor efficiency have increased range, reduced weight, and improved user experience. - Health, Accessibility and Demographic Shifts

E-bikes lower the physical barrier to cycling, extending riding to older age groups and wider socioeconomic segments. - Policy and Financial Incentives

Subsidies, tax incentives, bike-to-work programs, and investments in cycling infrastructure accelerate consumer adoption. - Cost of Car Ownership and Fuel Volatility

Owning and operating an e-bike is generally cheaper than a car for short urban trips, making it attractive during periods of high fuel and maintenance costs.

Market Segmentation

By Product Type

- Pedelecs (Pedal-Assist) — dominant for commuter and leisure use.

- Throttle-Assist E-Bikes — used where immediate motor power is required.

- Cargo & Utility E-Bikes — designed for deliveries and heavy loads.

- Folding E-Bikes — last-mile and mixed-mode commuters.

- Performance & E-MTB — sport and recreational segment.

By Motor Type

- Hub Motors — simpler, cost-effective, common in entry and mid segments.

- Mid-Drive Motors — higher torque and efficiency, preferred for performance and cargo bikes.

By Battery Configuration

- Integrated Frame Batteries — better aesthetics and protection.

- Removable Pack Batteries — convenient for charging and swap systems.

By Sales Channel

- Direct to Consumer (online)

- Specialty Retail & Local Dealers

- Fleet Sales & B2B (delivery, rental operators)

By End-User

- Commuting & Urban Mobility

- Commercial & Logistics

- Leisure & Sport

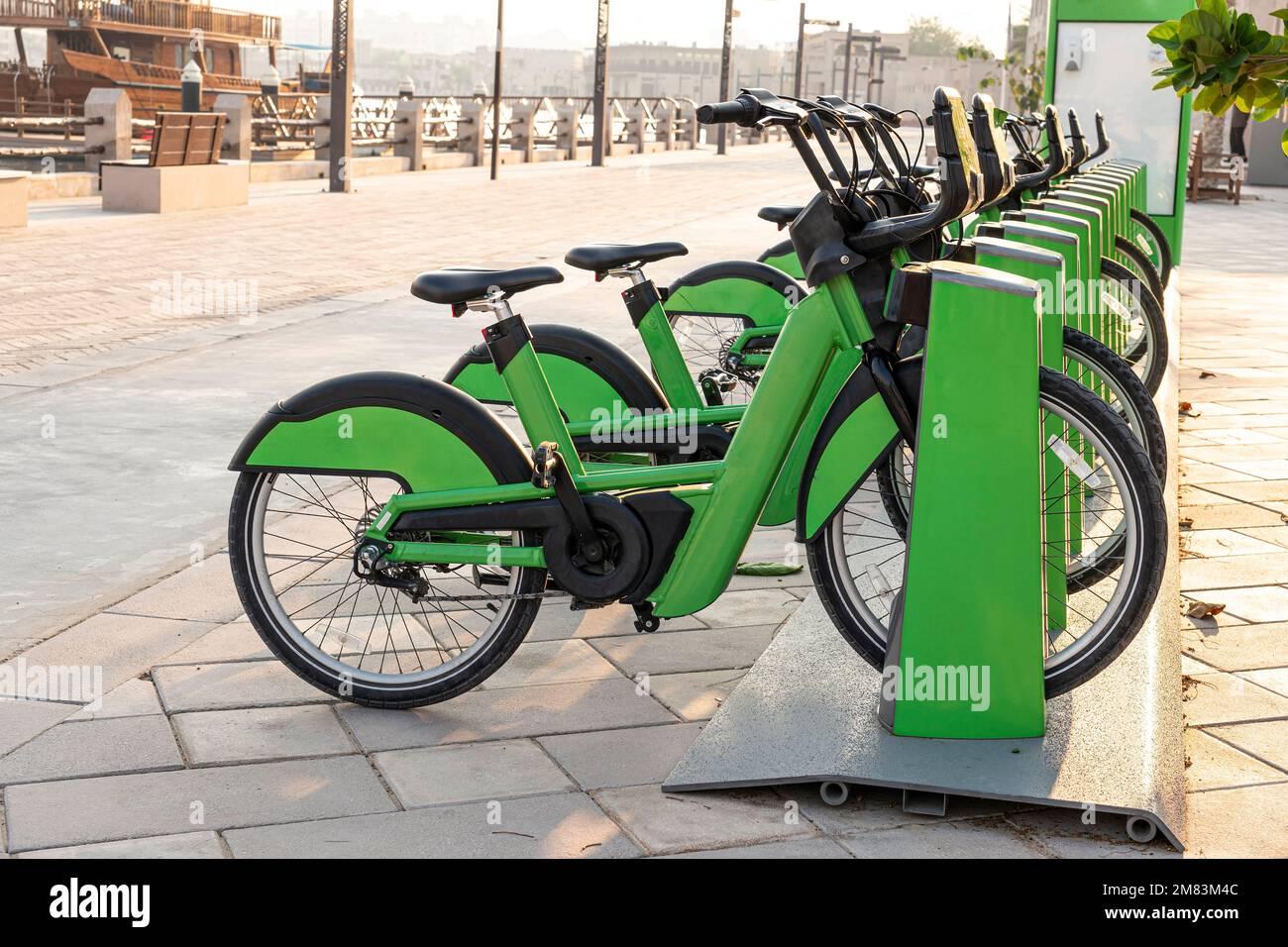

- Shared Mobility & Rental Services

Regional Insights

North America

Strong growth in commuter, recreational, and cargo e-bike segments. Suburban commuters and recreational riders are large adopters; policy incentives vary by city/state.

Europe

Leading region due to dense urban cores, cycling culture, strong infrastructure, and supportive policies. Cargo e-bikes for last-mile logistics are particularly advanced in northern European cities.

Asia-Pacific

High demand in China—both manufacturing hub and largest domestic market—followed by rapid growth in Southeast Asia, Japan and South Korea. Use cases include commuting and delivery; affordability and scaled manufacturing play major roles.

Latin America

Emerging market with pilot programs in urban centers; commercial adoption for deliveries is growing.

Middle East & Africa

Selective uptake in affluent urban areas and tourism; infrastructure and climate considerations influence product design and adoption.

Competitive Landscape

The market includes traditional bicycle manufacturers, dedicated e-bike startups, component specialists (motors, batteries), and technology firms offering software and fleet management. Competitive dynamics focus on:

- Product differentiation (range, weight, motor feel, cargo capacity)

- Component partnerships (motor and battery suppliers)

- Vertical integration (in-house battery systems or motor design)

- After-sales service networks and warranty

- Fleet & B2B contracts (logistics providers, city fleets)

- Pricing and financing options (leasing, subscriptions)

Major manufacturers coexist with regional brands and a fragmented set of local dealers. New entrants often compete on design, light weight, or targeted niches (e-cargo, folding, premium e-MTB).

Technological & Product Trends

- Higher Energy Density Batteries & Faster Charging — enabling longer range and shorter downtime.

- Battery Swapping & Shared Charging Infrastructure — emerging for fleet operators to maintain high utilization.

- Lightweight Materials & Integrated Frames — reduce weight and improve handling.

- Connected E-Bikes & Telematics — GPS tracking, anti-theft systems, ride data, and predictive maintenance for fleets.

- Smart Motor Control & Regenerative Braking — improve efficiency and extend range.

- Modular Cargo Systems — configurable platforms for urban logistics.

- Subscription and Mobility-as-a-Service (MaaS) Models — lowering entry barriers and enabling trial adoption.

Challenges and Restraints

- Safety and Infrastructure Gaps — inadequate protected bike lanes and road safety concerns can limit adoption.

- Regulatory Fragmentation — inconsistent classification, speed limits, and helmet laws across jurisdictions create market complexity.

- Battery Supply and Cost Volatility — dependence on critical raw materials and battery pack costs affect retail pricing.

- Theft and Vandalism — security remains a concern; robust locking and tracking systems add cost.

- After-sales Service & Warranty Management — maintenance networks are essential for consumer confidence, especially outside major urban centers.

- Perception and Cultural Barriers — in some markets e-bikes face stigma as “not real cycling” or lack of consumer awareness about benefits.

Future Outlook (2024–2032)

E-bikes are expected to become a mainstream transport mode for short to medium urban trips and a preferred tool for last-mile commercial delivery. Key forecasted developments:

- Wider Fleet Deployments — logistics, postal services, and food delivery companies will further expand e-cargo fleets, replacing vans in dense urban cores.

- Intermodal Integration — e-bikes will be increasingly integrated into transit systems (park-and-ride, multimodal apps) and mobility platforms.

- Policy Acceleration — more cities will introduce financial incentives, low-emission zones, and cycling infrastructure that favor e-bike adoption.

- Total Cost of Ownership Advantage — as battery and component costs fall and usage models scale, e-bikes will become even more cost-competitive versus small cars and scooters for many trips.

- Product Maturation — improvements in range, weight, durability, and connectivity will broaden appeal to older demographics and professional users.

- Circularity and Battery Recycling — stronger regulatory and industry initiatives will emerge for battery reuse, second-life applications, and end-of-life recycling.

By 2032, e-bikes will be a foundational micromobility solution in most major cities, supporting sustainable transport targets, reducing congestion, and reshaping urban delivery logistics.

Conclusion

The global electric bicycle market is undergoing rapid transformation—driven by technological advances, shifting consumer preferences, urban policy measures, and the growth of micromobility services. E-bikes bridge gaps between public transit, walking, and private car use, providing an efficient, low-emission option for commuters, businesses, and leisure riders alike.

To fully realize the potential of e-bikes, stakeholders must address infrastructure, safety, battery lifecycle, and regulatory consistency. Manufacturers that combine reliable hardware, integrated software, strong service networks, and tailored B2B solutions will be best positioned to capture growth across consumer and commercial segments. As cities and consumers continue to prioritize sustainability and convenience, electric bicycles are set to play an increasingly central role in the mobility mix through 2032.

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness