Next-Gen Composites: Market Dynamics and Growth Prospects

Nanocomposites combine a matrix material—polymers, metals, or ceramics—with nanoscale fillers such as carbon nanotubes, graphene, nanoclays, nanosilica, or metal nanoparticles. The result is a class of materials that retain the formability and processability of the matrix while acquiring enhanced mechanical strength, thermal stability, barrier performance, electrical or thermal conductivity, and new functional properties (antimicrobial, flame retardant, sensing).

Across automotive, aerospace, electronics, energy, construction, medical devices, and packaging, nano-composites are being used to meet stricter performance, weight, durability, and sustainability requirements. As manufacturing processes mature and cost profiles improve, nano-composites are shifting from niche R&D applications into larger volume industrial use.

Market Overview

The nano-composites market spans material systems (polymer nano-composites, metal matrix nano-composites, ceramic nano-composites), filler types (carbon-based, inorganic, hybrid), and application segments. Key value propositions include:

- Significant increases in tensile strength, modulus, and impact resistance at low filler loadings

- Improved thermal stability and flame retardancy for high-temperature or safety-sensitive uses

- Electrical and thermal conductivity enabling lightweight heat-management or EMI shielding solutions

- Barrier and anti-permeation properties useful for packaging, coatings, and membranes

- Possibility to introduce smart functionality (sensing, antimicrobial action, self-healing triggers)

Adoption is being driven by performance-led sectors (aerospace, electric vehicles, electronics) and by manufacturers seeking material solutions that enable lighter, more efficient, or longer-lasting products.

Click here to download a sample report

Key Market Drivers

- Lightweighting and Performance Demands

Pressure to reduce weight while increasing strength—especially in automotive and aerospace—drives nano-composite uptake. - Electrification and Thermal Management Needs

EVs, power electronics, and high-density batteries require materials that manage heat and electromagnetic interference. - Miniaturization in Electronics

Nano-composites enable smaller, high-performance components with improved thermal and electrical properties. - Sustainability and Material Efficiency

Enhanced properties at low filler content can lower overall material use and lifecycle impacts; bio-based matrices combined with nano-fillers are emerging. - Advanced Manufacturing and 3D Printing

Additive manufacturing with nano-composite feedstocks opens new design freedom and part consolidation opportunities. - R&D and Industry Collaboration

Partnerships between material suppliers, OEMs, and research institutes accelerate commercialization and application engineering.

Market Segmentation

By Material Matrix

- Polymer Nano-composites — thermoplastics and thermosets reinforced with nanofillers; largest and fastest-growing segment due to processing versatility.

- Metal Matrix Nano-composites (MMNCs) — used where stiffness, thermal conductivity, and high-temperature strength matter.

- Ceramic Nano-composites — for wear resistance, high-temperature and corrosion-resistant applications.

By Filler Type

- Carbon-based Fillers — carbon nanotubes, graphene/graphene oxide, carbon nanofibers (key for mechanical, electrical, thermal enhancements).

- Nanoclays and Nanosilica — improve barrier, mechanical and thermal properties at low cost.

- Metal/Metal Oxide Nanoparticles — add functionality (catalysis, antimicrobial, conductivity).

- Hybrid Fillers — engineered combinations to balance cost and multifunctionality.

By Manufacturing Process

- Melt Compounding & Extrusion — high throughput for thermoplastics.

- In-situ Polymerization — improved dispersion and interfacial bonding for certain systems.

- Solvent Casting & Coating — thin films and specialized coatings.

- Powder Metallurgy & Sintering — for metal and ceramic nano-composites.

- Additive Manufacturing (3D Printing) — expanding use for complex geometries and rapid prototyping.

By Application

- Automotive & Transportation — structural parts, battery housings, EMI shielding, coatings.

- Aerospace & Defence — high-performance structural components, thermal protection.

- Electronics & Electrical — heat spreaders, conductive adhesives, flexible electronics.

- Energy & Power — wind turbine components, battery systems, fuel cells.

- Medical Devices & Healthcare — implants, antimicrobial surfaces, diagnostic housings.

- Packaging & Coatings — barrier films, active packaging, anti-microbial coatings.

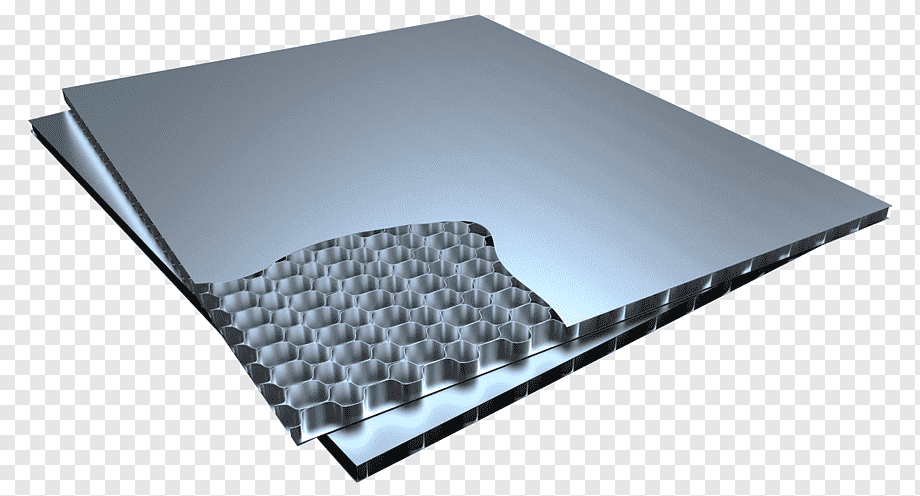

- Construction & Infrastructure — durable, lightweight composites for panels, membranes, and coatings.

Regional Insights

- North America — strong presence in high-value aerospace, defense, and electronics applications; robust R&D and pilot manufacturing.

- Europe — leadership in automotive lightweighting, specialty composites, and regulations that encourage high-performance, durable materials.

- Asia-Pacific — fastest growing due to large manufacturing bases, electronics production, automotive manufacturing, and scaling of material production capacity.

- Latin America — emerging applications in construction and automotive components; growing pilot projects and regional supply chains.

- Middle East & Africa — selective adoption in energy, construction and oil & gas sectors; gradual growth tied to industrial investment.

Competitive Landscape

The market blends multinational chemical and materials companies, specialized nanomaterial producers, composite fabricators, and technology startups. Competitive priorities include:

- Filler dispersion and interface engineering — companies that can achieve uniform nanoscale dispersion with strong interfacial bonding deliver the best performance.

- Scalable, cost-effective manufacturing — moving from lab to industrial volumes remains a key barrier and differentiator.

- Regulatory compliance and safety validation — demonstrating safe use, minimal migration, and end-of-life handling is commercially important.

- Application partnerships and system solutions — suppliers offering design support, pilot runs, and co-development with OEMs gain traction.

- Sustainability positioning — developing bio-based matrices, low-energy processes, and recyclable composite systems is increasingly strategic.

Prominent technology suppliers and composite firms are expanding portfolios through licensing, joint ventures, and targeted acquisitions to secure feedstock, processing know-how, and market access.

Technological & Product Trends

- Graphene and Carbon Nanotube Scaling — improved synthesis, functionalization, and lower cost routes enhance broad industrial use.

- Hybrid Nano-fillers — engineered blends of nanosilica, nanoclay, and carbon fillers to achieve multifunctionality with optimized cost.

- Surface Functionalization — chemical treatments that improve compatibility between nano-fillers and matrices, enabling superior mechanical transfer and reduced agglomeration.

- Nano-enabled Additive Manufacturing — printable nano-composite filaments and resins for tailored parts with enhanced properties.

- Smart and Responsive Composites — integration of sensing, self-healing, and conductive pathways at nanoscale for IoT-ready parts.

- Low-Energy and Green Processing — solvent-free methods, aqueous dispersions, and bio-derived matrices reduce environmental footprint.

Challenges and Restraints

- Scale-up and Cost — producing high-quality nanofillers at industrial volumes and acceptable prices remains a hurdle for mass markets.

- Dispersion and Processability — nanoparticles tend to agglomerate; achieving consistent dispersion without degrading matrix properties requires specialist equipment and know-how.

- Health, Safety and Environmental Concerns — worker exposure, lifecycle impacts, and nanoparticle fate require clear regulation and risk mitigation.

- Recycling and End-of-Life — complex multi-material composites are difficult to recycle; designing for circularity is technically and economically challenging.

- Standards and Certification — lack of harmonized standards for nano-composite characterization and performance testing can slow adoption in regulated industries.

Future Outlook (2024–2032)

The nano-composites market is set for steady expansion as technical and economic barriers are progressively addressed. Key expectations include:

- Broader Automotive Penetration — increased use in electric vehicles for structural components, crash management, battery enclosures and thermal management systems.

- Electronics Miniaturization — wider application in high-performance, miniaturized electronics where thermal and EMI management are critical.

- Energy Sector Applications — nanocomposites in wind blades, hydrogen storage, and battery components as demand for renewable and energy storage infrastructure grows.

- Medical Device Adoption — antimicrobial and mechanically superior implantable materials, plus lightweight housings for diagnostic equipment.

- Manufacturing Maturity — improved dispersion technologies, roll-to-roll processing, and printable nano-composite inks dramatically reduce unit costs and open new high-volume applications.

- Sustainability Integration — focus on recyclable composite architectures, bio-based matrices, and life-cycle assessment will increase, driven by regulation and OEM procurement criteria.

Market growth will be supported by continued R&D, targeted investments in manufacturing scale, and regulatory frameworks that balance safety with innovation.

Conclusion

Nano-composites represent a powerful material platform enabling step-changes in performance across many industrial sectors. They deliver superior strength, multifunctionality, and smart capabilities while supporting trends toward lightweighting, electrification, and miniaturization. The transition from laboratory promise to industrial reality hinges on scalable filler production, advanced dispersion and processing technologies, clear safety and recycling strategies, and close collaboration between material suppliers and end-use OEMs.

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness