Private Pension Insurance Market Size, Growth & Research Report (2025-2033) | UnivDatos

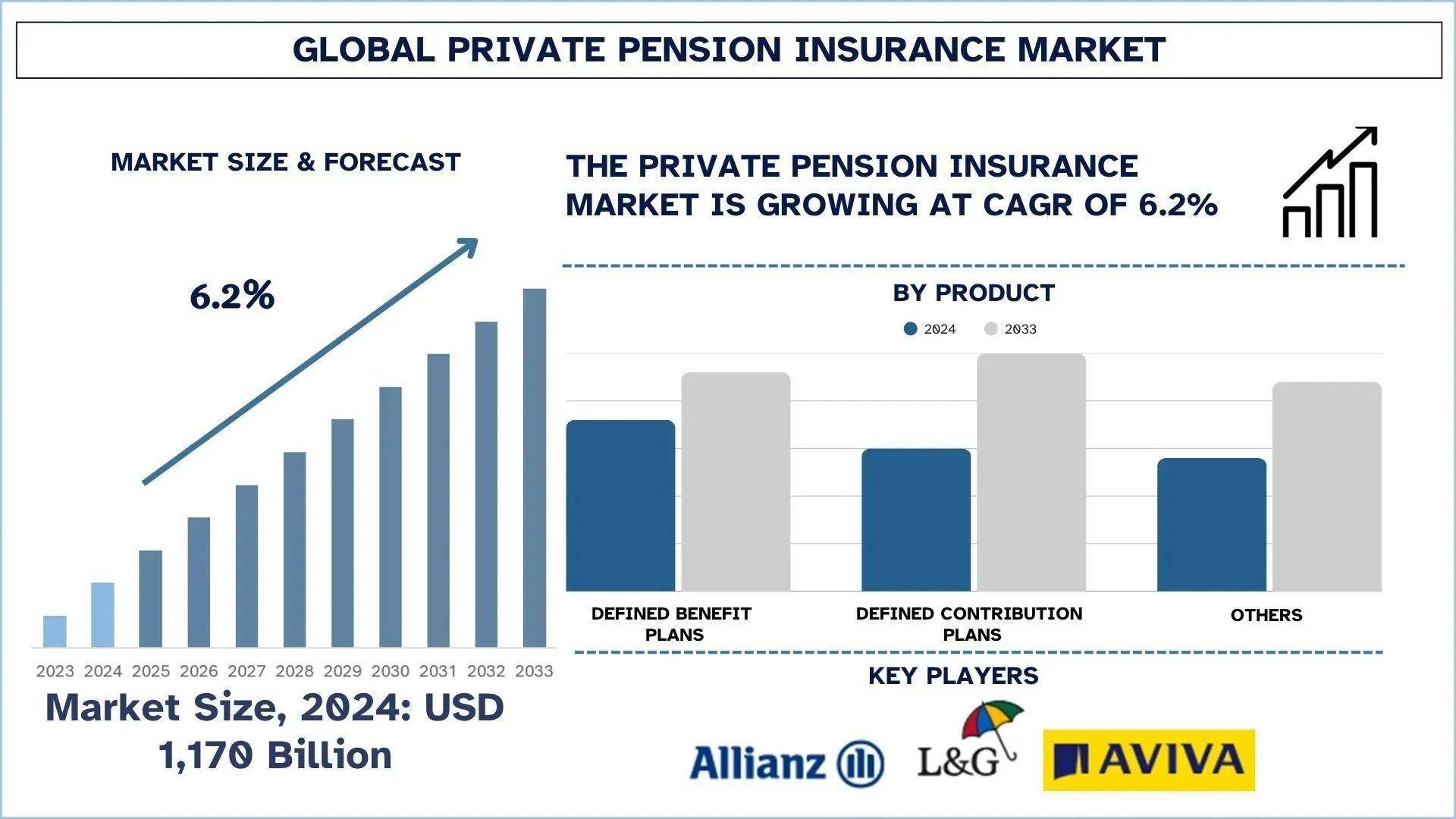

According to the UnivDatos analysis, the rising aging populations, declining state pension benefits, and growing awareness of retirement planning are the major factors driving the growth of the private pension insurance market worldwide. As per their “Private Pension Insurance Market” report, the global market was valued at USD 1,170 billion in 2024, growing at a CAGR of about 6.2% during the forecast period from 2025 - 2033 to reach USD billion by 2033.

Private pension insurance refers to a retirement savings plan in which people get some money for retirement under an arrangement with private insurers or financial institutions. Private pension insurance, which is typically open only to the private sector and which is typically voluntary and funded by periodic premiums paid by the persons insured, is different from public pension systems operated by governments. The contract for these plans either pays out a lump sum or an annual income after retirement. For those who do not fall within the scope of employer-sponsored pensions, it is especially beneficial to use private pension insurance, which helps ensure financial security in old age.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/private-pension-insurance-market?popup=report-enquiry

1. Shift Toward Defined Contribution (DC) Plans

Employers are choosing Defined Contribution (DC) pension plans instead of Defined Benefit (DB) plans to get rid of long-term liabilities and make others handle their investments. DC plans are more flexible and easy to understand, fitting the needs of today’s working society, mainly among young professionals and those who travel often. Because of this trend, both individuals and private pension policy providers are motivated to offer and use personalized, digitally based solutions for saving during retirement. Moreover, in areas where companies are unable to pay their pension obligations, DC plans are a good option since they can be scaled and are not dependent on the ups and downs of the economy.

2. ESG Integration in Pension Funds

More pension insurer firms are starting to use Environmental, Social, and Governance (ESG) factors in making their investment decisions. As people want their investments to be sustainable and ethical, private pension insurers are investing their funds according to ESG guidelines. Additionally, doing this results in producing less carbon, owning green bonds, and setting new rules for companies. When ESG is part of a company, it helps customers trust the brand and reduces the chances of facing major risks in the future. Pension funds and insurers are now including sustainability, supported by rules and evidence that ESG investments bring more profits, as a core part of their strategy and to make them stand out in a budget-conscious market.

3. Automation and AI in Fund Management

Fund management is enhancing in the private pensions sector with the help of automation and artificial intelligence (AI). Using AI, investors can get faster and better analysis of their portfolios, as well as personal investment plans using real-time data analysis. Additionally, with automation, companies can make sure premium processing, compliance reports, and new customer registration are completed more quickly and cost less. They are helping users by giving them financial advice that matches their needs. Because more people want online insurance services, AI and automation now play vital roles in boosting the insurance industry’s innovation, scalability, and use of data in the pension sector.

Click here to view the Report Description & TOC https://univdatos.com/reports/private-pension-insurance-market

Future Trends Fueling the Growth of the Private Pension Insurance Market

The private pension insurance market is set to grow because of ongoing future trends such as the gradual shift of customers toward defined contribution (DC) plans, ESG integration in pension funds, and the application of automation and AI in fund management. These trends are accelerating the private pension insurance market globally and promoting the worldwide adoption and demand of pension insurance among the population.

Related Report

Private Health Insurance Market: Current Analysis and Forecast (2024-2032)

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Dental Insurance Market: Current Analysis and Forecast (2025-2033)

Pet Insurance Market: Current Analysis and Forecast (2025-2033)

Cyber Insurance Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness