South Korea Cyber Insurance Market Share, Trends, Growth & Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Cyber Insurance Market Overview

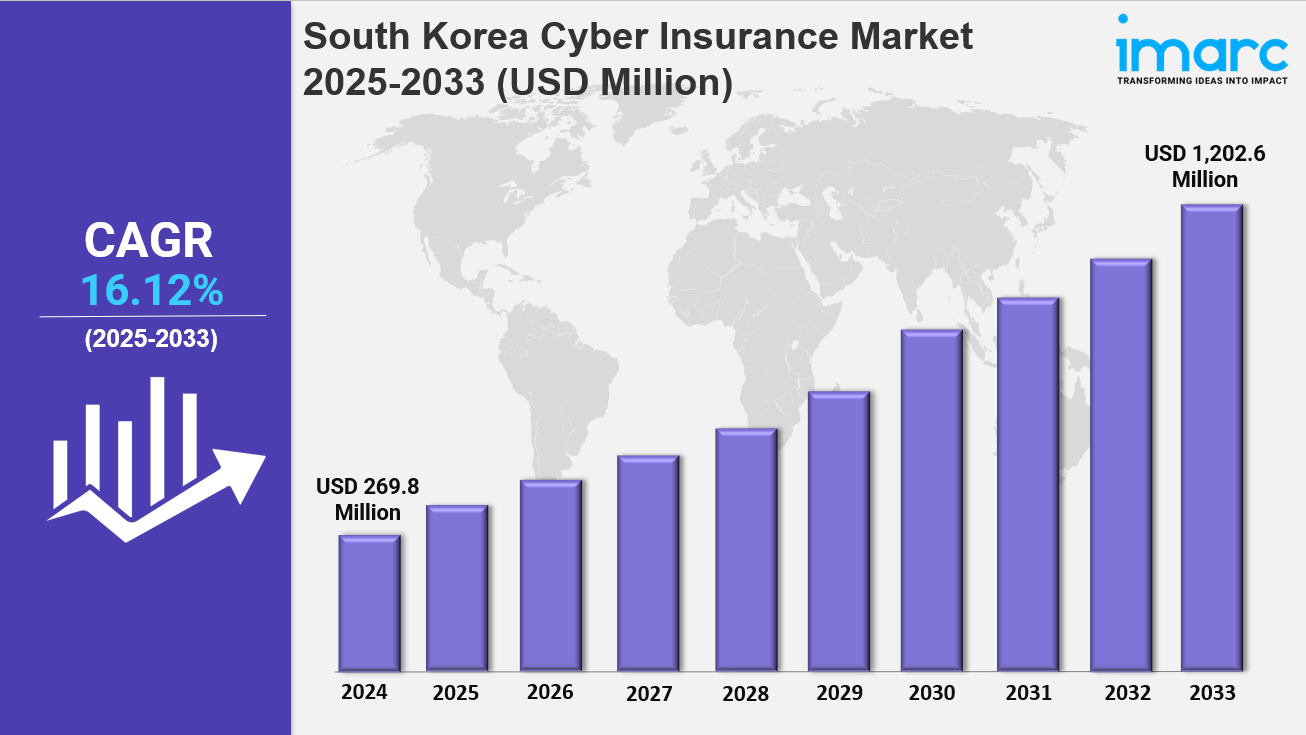

The South Korea cyber insurance market size reached USD 269.8 Million in 2024. Looking forward, the market is projected to reach USD 1,202.6 Million by 2033, exhibiting a growth rate (CAGR) of 16.12% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 269.8 Million

Market Forecast in 2033: USD 1,202.6 Million

Market Growth Rate (2025-2033): 16.12%

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-cyber-insurance-market/requestsample

Key Market Highlights:

✔️ Significant growth driven by escalating cyber threats and data breach incidents

✔️ Rising demand for comprehensive coverage options tailored to various industry needs

✔️ Increasing awareness of the importance of cybersecurity measures among businesses

South Korea Cyber Insurance Market Trends and Drivers:

Increasing Frequency of Cyber Threats

One of the primary dynamics driving the South Korea Cyber Insurance Market is the increasing frequency and sophistication of cyber threats. As cyberattacks become more prevalent, businesses across various sectors are recognizing the need for robust protection against potential financial losses. By 2025, the South Korea Cyber Insurance Market Size is expected to grow significantly as organizations invest in insurance products that cover data breaches, ransomware attacks, and other cyber incidents. This growing awareness is prompting companies to reassess their risk management strategies and seek comprehensive coverage that not only protects their assets but also ensures business continuity in the face of cyber disruptions. As a result, the demand for cyber insurance is rapidly escalating, positioning it as a critical component of modern business operations.

Expanding Regulatory Landscape

Another crucial factor influencing the South Korea Cyber Insurance Market is the expanding regulatory landscape surrounding data protection and cybersecurity. With the implementation of stricter data privacy laws and regulations, businesses are increasingly required to demonstrate compliance, which often includes securing adequate insurance coverage. By 2025, the South Korea Cyber Insurance Market Share is projected to increase as organizations seek policies that align with regulatory demands and provide financial protection against non-compliance penalties. This trend is particularly relevant for industries that handle sensitive data, such as finance, healthcare, and e-commerce, where the stakes are high. As regulations evolve, companies are compelled to prioritize cyber insurance as part of their overall compliance strategy, thereby driving market growth.

Growing Awareness of Cyber Risk Management

The growing awareness of cyber risk management among businesses is another significant dynamic shaping the South Korea Cyber Insurance Market Growth. As organizations become more educated about the potential impacts of cyber threats, they are increasingly adopting proactive measures to mitigate risks. By 2025, there is an anticipated rise in the integration of cyber insurance into broader risk management frameworks, with companies recognizing the importance of having both preventative and protective strategies in place. This shift is fostering a culture of cybersecurity that emphasizes not only insurance coverage but also the implementation of robust cybersecurity practices. Insurers are responding by offering tailored products that address specific industry needs and risk profiles, further enhancing the appeal of cyber insurance. As businesses continue to prioritize cybersecurity, the market is poised for substantial growth, reflecting the critical role that cyber insurance plays in safeguarding against digital threats.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=39195&flag=C

South Korea Cyber Insurance Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Component Insights:

- Solution

- Services

Insurance Type Insights:

- Packaged

- Stand-alone

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness