Asia-Pacific Digital Lending Platform Market Insights and Growth Trends

"Executive Summary Asia-Pacific Digital Lending Platform Market :

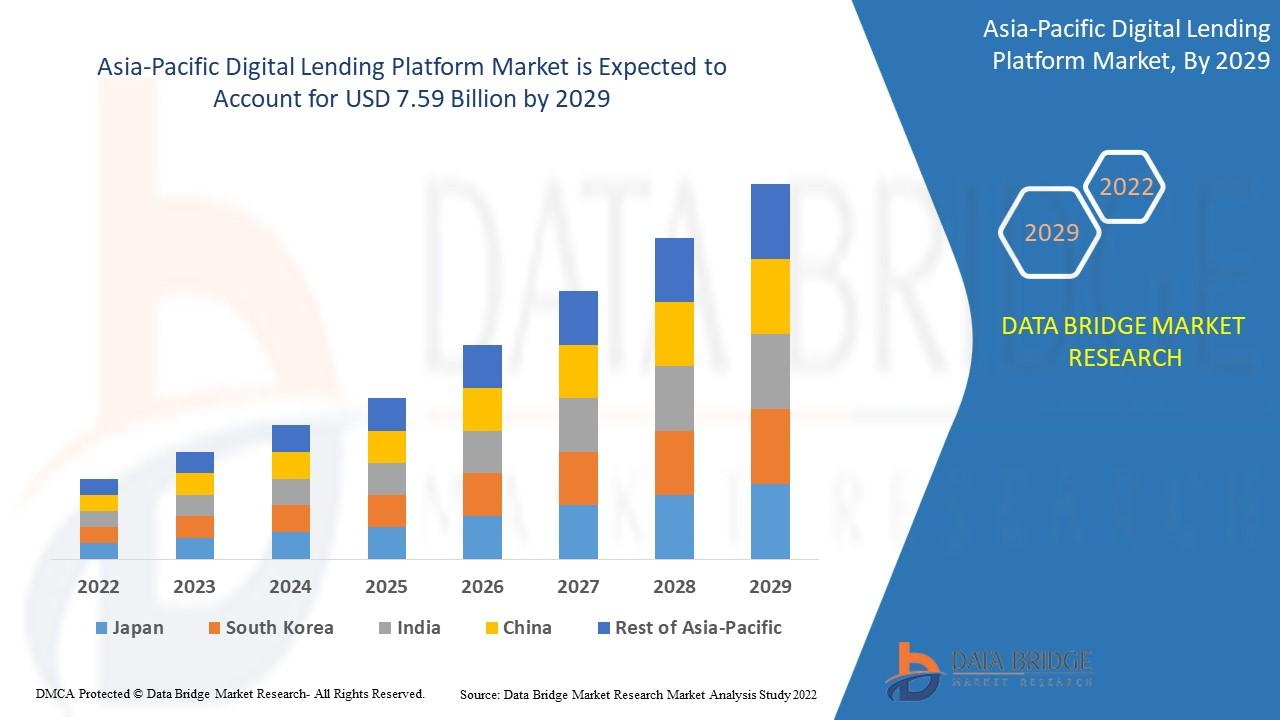

Asia-Pacific digital lending platform market size was valued at USD 2.50 billion in 2023, is projected to reach USD 10.98 billion by 2031, with a CAGR of 20.3% during the forecast period 2024 to 2031.

This global Asia-Pacific Digital Lending Platform Market research report encompasses drivers and restraints for the market which are derived from the well-established SWOT analysis. The market report is a synopsis of the market facts, stats and figures for the forecast period of 2018 - 2025. Market definition, market segmentation, key developments in the market, competitive analysis and research methodology are the major topics in which this Asia-Pacific Digital Lending Platform Market business document is divided. This industry report covers all the market shares and approaches of the major competitors or the key players in the market. Asia-Pacific Digital Lending Platform Market report also identifies significant trends and factors driving or inhibiting the market growth.

Asia-Pacific Digital Lending Platform Market report studies the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors with the Porter's Five Forces analysis. This market report takes into consideration several industry research, customer insights, market sizing & forecast, competitive analysis, market entry strategy, pricing trends, sustainability trends, innovation trends, technology evolution, and distribution channel assessment. The market report has been specially designed by keeping in mind the customer requirements with which businesses can get assistance in increasing their return on investment (ROI).

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Asia-Pacific Digital Lending Platform Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market

Asia-Pacific Digital Lending Platform Market Overview

**Segments**

- By Offering: Digital Lending Platform, Risk Management Solution, and Others.

- By Deployment Model: On-Premises, and Cloud.

- By End-User: Banks, NBFCs, Credit Unions, and Others.

- By Country: China, Japan, South Korea, India, Australia, and Rest of Asia-Pacific.

The Asia-Pacific digital lending platform market is witnessing significant growth due to the increasing adoption of digital technologies in the lending industry. The offering segment is expected to dominate the market as digital lending platforms offer a wide range of solutions that cater to the diverse needs of financial institutions. The deployment model segment is divided between on-premises and cloud-based solutions, with cloud-based deployment gaining traction due to its scalability and cost-effectiveness. Among end-users, banks are the key adopters of digital lending platforms as they aim to streamline their lending processes and offer personalized services to customers. Geographically, China is expected to lead the market followed by Japan and India due to the rapid digitization of the financial sector in these countries.

**Market Players**

- Fiserv Inc.

- Nucleus Software

- RupeePower

- Newgen Software Technologies Limited

- Finantix S.p.A.

- Intellect Design Arena Ltd

- Sigma Infosolutions

Several key players are operating in the Asia-Pacific digital lending platform market, offering a wide range of products and services to cater to the evolving needs of financial institutions. Fiserv Inc. is a prominent player known for its innovative digital lending solutions that enhance operational efficiency and customer experience. Nucleus Software offers comprehensive lending platforms that enable financial institutions to automate and optimize their lending processes. RupeePower is another key player focusing on providing end-to-end digital lending solutions to streamline the loan origination and approval process. Newgen Software Technologies Limited offers cutting-edge technology solutions for digital lending, empowering financial institutions to deliver seamless customer experiences. Other notable players in the market include Finantix S.p.A., Intellect Design Arena Ltd, and Sigma Infosolutions, each contributing unique offerings to meet the diverse demands of the digital lending landscape in the Asia-Pacific region.

The Asia-Pacific digital lending platform market is poised for continued growth driven by the digital transformation trends within the lending industry. One key trend that is shaping the market is the increasing focus on data security and compliance. With the rise of digital lending platforms, financial institutions are placing a significant emphasis on ensuring the security and confidentiality of customer data, thereby driving the demand for advanced risk management solutions that can safeguard sensitive information. Market players are responding to this trend by developing robust risk management solutions that integrate cutting-edge security features to mitigate potential risks associated with digital lending operations.

Another important driver of market growth is the shift towards personalized lending experiences. As customers increasingly seek tailored financial solutions, banks and other financial institutions are leveraging digital lending platforms to offer personalized loan products and services. By harnessing data analytics and AI capabilities, these platforms enable lenders to assess individual borrower profiles, identify customized lending opportunities, and deliver a seamless borrowing experience. This trend towards personalized lending is not only enhancing customer satisfaction but also improving loan origination processes, leading to greater operational efficiency for financial institutions.

Furthermore, the evolving regulatory landscape is playing a significant role in shaping the Asia-Pacific digital lending platform market. Regulatory authorities across the region are introducing stringent guidelines and compliance requirements for digital lending activities to protect consumer interests and ensure financial stability. Market players are focusing on developing solutions that adhere to regulatory standards and facilitate seamless compliance management for financial institutions. This increased emphasis on regulatory compliance is driving the adoption of digital lending platforms that offer robust reporting and monitoring capabilities to ensure adherence to regulatory frameworks.

Moreover, the COVID-19 pandemic has accelerated the digital transformation of the lending industry in the Asia-Pacific region. The shift towards remote operations and online services has propelled the demand for digital lending platforms that enable seamless loan processing and disbursement without the need for physical interactions. Market players are innovating to meet this surge in demand by enhancing the scalability, flexibility, and accessibility of their digital lending solutions to support the evolving needs of financial institutions in a post-pandemic landscape.

Overall, the Asia-Pacific digital lending platform market is witnessing dynamic growth fueled by technological advancements, changing customer preferences, regulatory dynamics, and the impact of external factors like the pandemic. Market players that can anticipate and adapt to these market trends are well-positioned to capitalize on the vast opportunities presented by the digital lending landscape in the region.The Asia-Pacific digital lending platform market is experiencing a transformational shift propelled by technological innovations and changing dynamics within the financial services industry. One of the key trends shaping the market is the integration of artificial intelligence (AI) and machine learning algorithms into digital lending platforms. These technologies enable financial institutions to automate credit risk assessment, enhance underwriting processes, and personalize lending offerings based on individual borrower profiles. By leveraging AI, lenders can make data-driven decisions, improve risk management strategies, and streamline loan origination procedures, ultimately leading to a more efficient and customer-centric lending experience.

Another significant trend influencing the market is the rising demand for omnichannel lending solutions. As consumers increasingly prefer digital channels for their banking and financial needs, there is a growing emphasis on providing a seamless omnichannel experience across multiple touchpoints. Digital lending platforms that can integrate seamlessly with various online and offline channels enable financial institutions to engage customers effectively, provide real-time assistance, and deliver a consistent experience throughout the lending journey. This omnichannel approach not only enhances customer satisfaction but also boosts operational efficiency and helps drive loan origination volumes.

Moreover, the market is witnessing a surge in the adoption of mobile lending solutions as smartphones become ubiquitous and mobile applications gain popularity among tech-savvy consumers. Mobile lending platforms offer convenience, accessibility, and speed, allowing borrowers to apply for loans, submit documents, and receive approvals on-the-go. Financial institutions are increasingly investing in mobile-first strategies to cater to the growing base of mobile users and capitalize on the opportunities presented by the thriving mobile lending segment. By offering mobile-optimized interfaces, seamless user experiences, and secure transaction capabilities, digital lending platforms are reshaping the lending landscape and revolutionizing the way loans are processed and disbursed.

Furthermore, sustainability and social impact considerations are becoming key drivers for digital lending platforms in the Asia-Pacific region. With growing awareness around environmental, social, and governance (ESG) principles, financial institutions are incorporating sustainability criteria into their lending practices and investment decisions. Digital lending platforms that enable the assessment of ESG factors, support green financing initiatives, and promote social responsibility are gaining traction among lenders seeking to align their operations with sustainable development goals. By promoting responsible lending practices and fostering greater transparency in loan processes, these platforms are not only meeting regulatory requirements but also addressing the evolving expectations of socially conscious borrowers.

In conclusion, the Asia-Pacific digital lending platform market is undergoing a rapid transformation driven by technological advancements, changing consumer behaviors, regulatory developments, and shifting market dynamics. As the industry continues to evolve, market players need to stay abreast of these emerging trends, innovate their offerings, and adapt to the evolving needs of financial institutions and borrowers in order to remain competitive in this dynamic landscape. Digital lending platforms that can deliver personalized, omnichannel, mobile-friendly, and sustainable lending solutions are poised to thrive in the Asia-Pacific market and shape the future of the lending industry in the region.

The Asia-Pacific Digital Lending Platform Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key questions answered in the report:

- What will the market development pace of the Asia-Pacific Digital Lending Platform Market?

- What are the key factors driving the Global Asia-Pacific Digital Lending Platform Market?

- Who are the key manufacturers in the Asia-Pacific Digital Lending Platform Marketspace?

- What are the market openings, market hazard and market outline of the Asia-Pacific Digital Lending Platform Market?

- What are sales, revenue, and price analysis of top manufacturers of Asia-Pacific Digital Lending Platform Market?

- Who are the distributors, traders, and dealers of Asia-Pacific Digital Lending Platform Market?

- What are the Asia-Pacific Digital Lending Platform Market opportunities and threats faced by the vendors in the Global Asia-Pacific Digital Lending Platform Marketindustries?

- What are deals, income, and value examination by types and utilizations of the Asia-Pacific Digital Lending Platform Market?

- What are deals, income, and value examination by areas of enterprises?

Browse More Reports:

Global Autoimmune Hemolytic Anemia Treatment Market

Asia-Pacific Trash Bags Market

Global Natural Food Colors and Flavors Market

Middle East and Africa Mild Cognitive Impairment (MCI) Treatment Market

Europe Core Materials Market

Global Vegan Waxes Market

Global Inductor Market

Global Sodium Citrate Market

Global GRP Pipes Market

Global Oral Care Products - Other Dental Consumables Market

Middle East and Africa Personal Watercraft Market

Global Micellar Casein Market

Global Orthopedic Implants (Including Dental Implants) Market

Global Curved Televisions Market

Middle East and Africa Digital Lending Platform Market

Global Digital Lending Platform Market

Global Camping Cooler Market

Europe Lung Transplant Therapeutics Market

Global Hexamethylenetetramine Market

Global Transcutaneous Monitors Market

Europe Omega-3 for Food Application Market

Global Grip Tape Market

Global Prion Disease Treatment Market

Global Glycidyl Methacrylate Market

Global Polyisoprene (PI) Surgical Gloves Market

North America Ink Resins Market

Global Avermactin Market

Global Silicon Alloys Market

Global Swabs Collection Kits Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

"

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness