Where the Rubber Meets the Road: How the Two-Wheeler Tires Market Is Gearing Up for the Next Ride

It’s early morning in Mumbai. As the city stirs, hundreds of thousands of scooters and motorbikes buzz through alleys, highways, and traffic-clogged lanes. From delivery boys zipping through deadlines to daily commuters avoiding the crammed metro, two-wheelers are more than a vehicle in much of the world—they’re a way of life.

To get free sample, Register Here: https://www.stratviewresearch.com/Request-Sample/2935/two-wheeler-tires-market.html#form

But here’s what few consider: the only thing between that two-wheeler and the road is two palm-sized patches of rubber—its tires.

And in an increasingly urbanized, cost-conscious, and environmentally demanding world, those tires are doing more heavy lifting than ever.

The Real Grip Problem: Outdated Tires in a Changing Mobility Landscape

Globally, two-wheelers are the most popular form of personal transportation. With more than 600 million units on the road, their dominance spans Asia, Latin America, and Africa.

But as demand for two-wheelers grows—driven by urban congestion, last-mile delivery, and rising fuel prices—the expectations from their tires have skyrocketed:

-

Performance in extreme climates

-

Durability on poor or unpaved roads

-

Fuel efficiency through rolling resistance

-

Affordability without compromising safety

Add to that the rising share of electric two-wheelers, which carry heavier battery loads and require torque-friendly grip patterns, and it becomes clear: the traditional tire market has hit a curve.

The Market Acceleration: What’s Driving Growth?

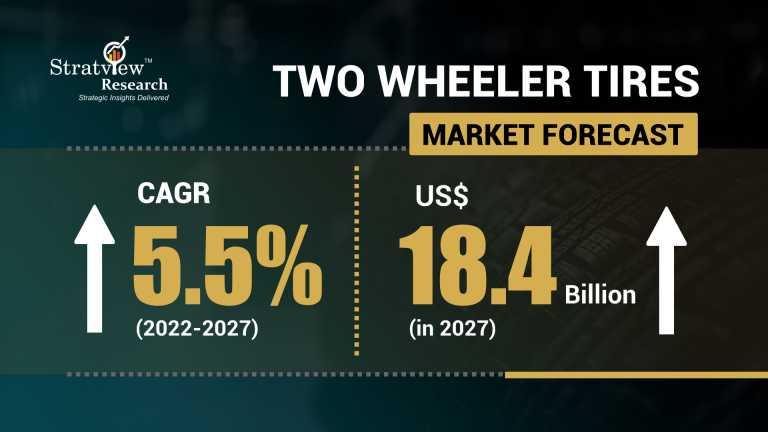

According to Stratview Research, the two-wheeler tires market was estimated at USD 13.19 billion in 2021 and is likely to grow at a CAGR of 5.5% during 2022-2027 to reach USD 18.4 billion in 2027.

That growth is fueled by several interconnected trends:

🛵 Explosive Sales in Emerging Economies: India, Indonesia, and Vietnam are witnessing double-digit growth in motorcycle and scooter ownership.

⚡ Rise of Electric Two-Wheelers: Asia-Pacific leads the EV2W revolution with government subsidies and fleet electrification efforts (e.g., India’s FAME-II scheme and China’s e-bike mandates).

📦 Last-Mile Logistics Boom: E-commerce has turned delivery riders into the backbone of logistics in urban centers, demanding high-mileage and puncture-resistant tires.

🌱 Sustainability Push: Recycled rubber content, low-rolling resistance treads, and longer lifespan are fast becoming regulatory and consumer expectations.

The Innovation Response: Reinventing the Tire for a Smarter Ride

To meet this evolving demand, tire manufacturers are moving from commodity to engineered performance.

Here’s how the game is changing:

-

Smart Compounds: Companies are using silica-reinforced treads, low-VOC binders, and oil-extended rubber for better grip and lower wear.

-

EV-Specific Tires: Special sidewall construction and tread patterns are being developed for electric scooters and bikes to handle instant torque and battery load.

-

Tubeless & Self-Sealing Designs: Increasingly popular in commuter segments for their lower maintenance and reduced puncture risk.

-

Dual-Compound Tires: Found in performance bikes, these tires combine hard centers for straight-line durability and softer sides for cornering grip.

Notable players like Michelin, MRF, TVS Eurogrip, Apollo Tyres, JK Tyre, Pirelli, and Maxxis are investing in regional R&D centers and retail network expansion—particularly in high-growth markets like India, Indonesia, and Brazil.

Stratview also notes that Asia-Pacific accounts for more than 70% of the global two-wheeler tire demand, with India alone contributing over one-third of global production.

What Forward-Thinking Players Are Doing

Companies that once sold tires as mere replacements are now branding them as enablers of safer, smarter mobility:

-

TVS Eurogrip has launched Duratrail and Protorq series targeting both EVs and sports bike riders.

-

Michelin is collaborating with EV startups for joint development of ultra-light tires for electric scooters.

-

Apollo is investing in digital tire tracking platforms for fleet operators to monitor wear and maintenance cycles.

Meanwhile, aftermarket brands are leveraging direct-to-rider e-commerce platforms, tapping into the DIY two-wheeler service trend.

Strategic Takeaways

-

The two-wheeler tire is no longer just a rubber commodity—it’s a strategic product supporting safety, sustainability, and ride experience.

-

With the EV boom, tires must evolve to handle weight, torque, and efficiency demands.

-

Players investing in smart materials, retail digitization, and regional adaptation will capture the next phase of growth.

-

Emerging markets will remain the demand engine, but innovation is increasingly global and cross-segment.

In the race for efficient, electric, and everyday mobility—traction matters. And it starts with two wheels.

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness