Cryptocurrency Banking Market Expands as Fintech Innovates for Digital Asset Integration

"Comprehensive Outlook on Executive Summary Cryptocurrency Banking Market Size and Share

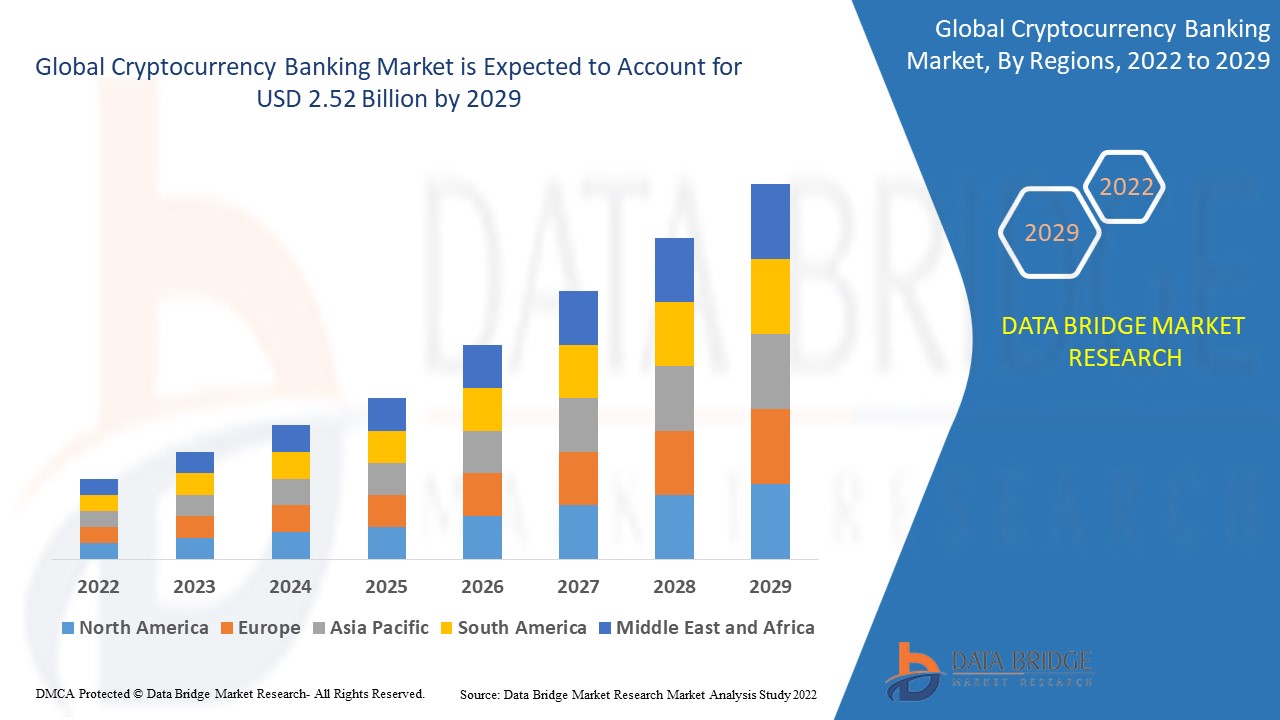

Data Bridge Market Research analyses that the cryptocurrency banking market was valued at USD 1.49 billion in 2021 and is expected to reach the value of USD 2.52 billion by 2029, at a CAGR of 6.80% during the forecast period

This competitive era calls for businesses to be equipped with knowhow of the major happenings of the market and Cryptocurrency Banking Market This Cryptocurrency Banking Market research report is comprehensive and object-oriented which is structured with the grouping of an admirable industry experience, talent solutions, industry insight and most modern tools and technology. To acquire knowhow of market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behaviour, this finest Cryptocurrency Banking Market research report is very crucial. This Cryptocurrency Banking Market report covers all the studies and estimations that are involved in the method of standard market research analysis.

Cryptocurrency Banking Market report comprises of all the crucial parameters mentioned above hence it can be used for your business. Furthermore, systemic company profiles covered in this report also explains what recent developments, product launches, joint ventures, mergers and acquisitions are taking place by the numerous key players and brands in the market. Cryptocurrency Banking Market report also endows with company profiles and contact information of the key market players in the key manufacturer’s section. The Cryptocurrency Banking Market report is provided with the transparent research studies which have taken place by a team work of experts in their own domain.

Access expert insights and data-driven projections in our detailed Cryptocurrency Banking Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market

Cryptocurrency Banking Industry Snapshot

**Segments**

- **Type:** The global cryptocurrency banking market can be segmented based on type into centralized, decentralized, and hybrid. Centralized banking is operated by a single entity, providing control over transactions and security measures. Decentralized banking operates on a peer-to-peer network, allowing for more privacy and eliminating the need for intermediaries. Hybrid banking combines elements of both centralized and decentralized systems.

- **Services:** Within the cryptocurrency banking market, services can be categorized into digital wallets, peer-to-peer transfers, crypto exchange platforms, and others. Digital wallets provide a secure way to store cryptocurrencies, while peer-to-peer transfers enable direct transactions between users. Crypto exchange platforms allow users to trade various cryptocurrencies.

- **End-User:** End-users of cryptocurrency banking services include individual investors, institutional investors, and merchants. Individual investors use cryptocurrency banking for investment purposes, while institutional investors seek to diversify their portfolios. Merchants can accept cryptocurrencies as a form of payment, benefiting from lower transaction fees and faster processing times.

**Market Players**

- **Coinbase:** Coinbase is a leading cryptocurrency exchange platform that offers a variety of banking services, including digital wallets and trading options. The platform is known for its user-friendly interface and stringent security measures.

- **Binance:** Binance is another prominent player in the cryptocurrency banking market, providing a wide range of services such as crypto trading, futures trading, and lending. The platform is popular for its extensive list of supported cryptocurrencies and competitive fees.

- **Kraken:** Kraken is a well-established cryptocurrency exchange that offers banking services like spot trading, futures trading, and staking. The platform is known for its high liquidity and advanced security features.

- **Gemini:** Gemini is a cryptocurrency exchange and custodian that provides services like trading, custody, and wallet storage. The platform is compliant with regulatory requirements and focuses on maintaining a high level of security for its users.

- **Bitfinex:** Bitfinex is a cryptocurrency exchange that offers margin trading, lending, and fiat-to-crypto trading. The platform is known for its advanced trading features and deep liquidity pools.

In conclusion, the global cryptocurrency banking market is witnessing significant growth driven by factors such as increasing adoption of digital currencies, rising demand for secure and efficient banking services, and technological advancements in the blockchain industry. As more players enter the market and offer innovative solutions, the landscape is expected to evolve rapidly. By catering to the diverse needs of individual investors, institutional investors, and merchants, cryptocurrency banking providers have the opportunity to capitalize on this growing market.

The global cryptocurrency banking market is poised for substantial growth in the coming years, propelled by a confluence of macroeconomic factors and technological advancements. One key driver of the market's expansion is the increasing acceptance and adoption of digital currencies worldwide. With the growing recognition of cryptocurrencies as legitimate financial assets, individuals, institutions, and merchants are increasingly turning to cryptocurrency banking services for investment, diversification, and payment needs. This trend is further bolstered by the emergence of new use cases for cryptocurrencies, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which are driving broader acceptance and utility of digital assets.

Moreover, the demand for secure and efficient banking services in the cryptocurrency space is fueling innovation among market players. Companies like Coinbase, Binance, Kraken, Gemini, and Bitfinex are continuously enhancing their platforms to provide a seamless and secure banking experience for users. This includes implementing robust security measures, expanding service offerings, and improving user interfaces to attract and retain customers. As competition intensifies in the cryptocurrency banking market, providers are likely to invest heavily in research and development to differentiate their offerings and gain a competitive edge.

Furthermore, technological advancements in the blockchain industry are reshaping the landscape of cryptocurrency banking. Innovations such as smart contracts, scalability solutions, and interoperability protocols are paving the way for more efficient and scalable banking services. These technologies not only improve the speed and cost-effectiveness of transactions but also enable new functionalities like automated asset management and cross-chain interoperability. As blockchain technology evolves, cryptocurrency banking providers will need to adapt and integrate these innovations into their platforms to stay ahead of the curve and meet the evolving demands of the market.

Looking ahead, the global cryptocurrency banking market is expected to experience continued growth and evolution as the industry matures and regulatory frameworks become more established. Market players will need to navigate regulatory challenges, cybersecurity threats, and market volatility to sustain their growth and credibility. By focusing on innovation, customer experience, and compliance with regulatory standards, cryptocurrency banking providers can capitalize on the vast opportunities presented by the burgeoning digital asset ecosystem. Overall, the future of cryptocurrency banking holds immense promise for those willing to embrace change, seize opportunities, and adapt to the dynamic market conditions.The global cryptocurrency banking market is undergoing a period of rapid transformation and growth, driven by various factors such as increasing acceptance of digital currencies, evolving consumer preferences, and technological innovations within the blockchain industry. One key trend shaping the market is the shift towards decentralized finance (DeFi) and non-fungible tokens (NFTs), which are creating new opportunities for individuals, institutions, and merchants to leverage cryptocurrencies for a wide range of financial activities beyond traditional banking services. This expansion of use cases is broadening the appeal and utility of digital assets, driving higher adoption rates and increasing the overall market size.

Market players in the cryptocurrency banking sector, such as Coinbase, Binance, Kraken, Gemini, and Bitfinex, are playing a crucial role in shaping the competitive landscape and driving innovation within the industry. These companies are focused on enhancing their service offerings, improving security measures, and providing a seamless user experience to attract and retain customers in an increasingly crowded market. By investing in research and development, these players are able to differentiate themselves and stay ahead of the curve in terms of technological advancements and evolving customer needs.

Regulatory developments also play a significant role in shaping the future of the cryptocurrency banking market. As governments around the world establish regulatory frameworks for digital assets, market players will need to navigate compliance requirements and regulatory challenges to ensure the long-term sustainability of their operations. Adhering to regulatory standards while maintaining a focus on customer experience and innovation will be crucial for cryptocurrency banking providers to build trust with users, regulators, and other stakeholders in the industry.

Looking ahead, the future of the global cryptocurrency banking market holds significant promise for those players who can adapt to changing market dynamics, regulatory environments, and technological advancements. By embracing innovation, focusing on customer needs, and remaining agile in responding to market trends, cryptocurrency banking providers can position themselves for long-term success in a rapidly evolving industry. As the market continues to mature and new opportunities arise, those companies that can effectively navigate the complexities of the digital asset ecosystem will be well-positioned to thrive and lead the way in shaping the future of cryptocurrency banking.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market/companies

Market Intelligence Question Sets for Cryptocurrency Banking Industry

- How big is the current global Cryptocurrency Banking Market?

- What is the forecasted Cryptocurrency Banking Market expansion through 2032?

- What core segments are covered in the report on the Cryptocurrency Banking Market?

- Who are the strategic players in the Cryptocurrency Banking Market?

- What countries are part of the regional analysis in the Cryptocurrency Banking Market?

- Who are the prominent vendors in the global Cryptocurrency Banking Market?

Browse More Reports:

Global Heart Scan Market

Global Antimicrobial Polymer Films Market

Asia-Pacific Technical Textile Market

North America Hydroxyl-Terminated Polybutadiene (HTPB) Market

Global Surge Arrester Market

Global Panel Mount Industrial Display Market

Global Tempeh Market

Global Nano Packaging Materials Market

Global Petri Dish Fillers Market

Global Wagyu Beef Market

Global Pathogen Detection Market

Global Non-Invasive Ventilation Masks and Circuits Market

Global Healthcare Smart Beds Market

Middle East and Africa Filters and Components Market

Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells (NF-κB) Inhibitors Market

Global Wood Chips Market

Global 2K Epoxy Adhesives Market

Global Prepared Meat and Seafood Equipment Market

Asia-Pacific Polyethylene Pipes Market

Middle East and Africa Retro-Reflective Materials Market

Global Aircraft Seat Actuation Systems Market

Global Manufactured Soils Market

Europe Defoamers for Potato Processing Market

India Silicon Carbide (SiC) Market

Middle East and Africa Hydroxyl-Terminated Polybutadiene (HTPB) Market

Europe Dermal Fillers Market

Global Point-of-Care (POC) Coagulation Testing Market

Global Extruded Polypropylene Foam Market

Europe Lymphedema Treatment Market

Global Imaging Flow Cytometer Equipment Market

Global Paddy Rice Market

Global Aluminum Alloy Market

Global Luxury Furniture Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness