Bank deposit insurance programme and norms to access funds

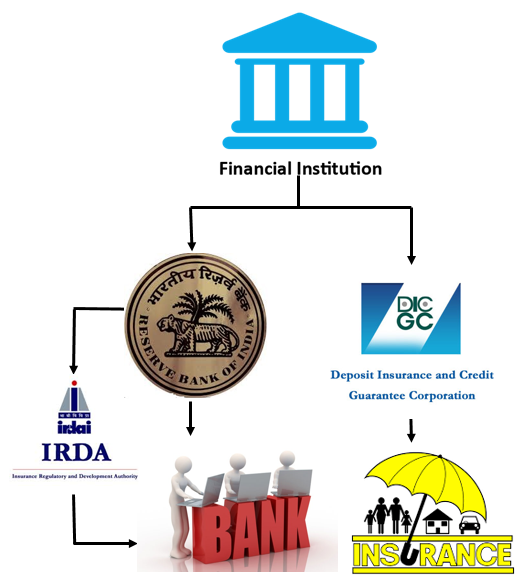

Prime Minister Narendra Modi Sunday said that Rs 1,300 crore had been paid to over 1 lakh depositors who could not access their money as their banks faced financial crises and that a further 3 lakh such depositors were set to receive funds stuck in such accounts. The PM noted that the deposits worth Rs 76 lakh crore were insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act providing full coverage to around 98 per cent of bank accounts.

The Centre had in August passed an amendment to the Deposit Insurance and Credit Guarantee Corporation Act to ensure that account holders can access their insured deposit amount within 90 days of such a liability arising in the event of a bank coming under the moratorium imposed by the Reserve Bank of India (RBI).

What did the PM say on deposit insurance?

The Prime Minister said any country can save the problems from getting worse only by timely resolution of them. Earlier, out of the amount deposited in the bank, only Rs 50,000 was guaranteed, which was then raised to Rs 1 lakh. “Understanding the concern of the poor, understanding the concern of the middle class, we increased this amount to Rs 5 lakh,” he said.

“Today is a very important day for the country, the banking sector and for crores of bank account holders,” the PM said at an event where he handed over cheques to cover insured sums to account holders who could not access their funds in distressed banks.

“If a bank is weak or is even about to go bankrupt, depositors will get their money of up to Rs five lakhs within 90 days,” Modi said, noting that earlier account holders “could not access their own money for upto 8-10 years after financial stress at banks”. The PM added that this would give confidence to depositors and strengthen the banking and financial system.

Changes in deposit insurance law

Troubles for depositors in getting immediate access to their funds in banks in recent cases such as Punjab & Maharashtra Co-operative (PMC) Bank, Yes Bank and Lakshmi Vilas Bank had put spotlight on the subject of deposit insurance, after which the government made changes to the deposit insurance laws in August this year to provide funds up to Rs 5 lakh to an account holder within 90 days in the event of a bank coming under the moratorium imposed by the RBI.

According to the finance ministry, depositors normally used to end up waiting for 8-10 years before they are able to access their deposits in a distressed bank only after its complete liquidation. Now with the changes to the law, depositors can get insurance money within 90 days, without waiting for eventual liquidation of the distressed banks.

This covers banks already under moratorium and those that could come under moratorium.

Within the first 45 days of the bank being put under moratorium, the DICGC would collect all information relating to deposit accounts. In the next 45 days, it will review the information and repay depositors closer to the 90th day.

What were the norms for deposit insurance earlier?

Earlier, account holders had to wait for years till the liquidation or restructuring of a distressed lender to get their deposits that are insured against default. Last year, the government raised the insurance amount to Rs 5 lakh from Rs 1 lakh. Prior to that, the DICGC had revised the deposit insurance cover to Rs 1 lakh on May 1, 1993 — raising it from Rs 30,000, which had been the cover from 1980 onward.

In an unlikely event of a bank failing in India, a depositor has a claim to a maximum of Rs 5 lakh per account as insurance cover. The cover of Rs 5 lakh per depositor is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which is a fully owned subsidiary of the Reserve Bank of India. Depositors having more than Rs 5 lakh in their account have no legal recourse to recover funds in case a bank collapses. While the depositors enjoy the highest safety on their funds parked with banks, unlike the equity and bond investors in the banks, an element of risk always lurks on their deposits in case a bank collapses.

https://indianexpress.com/article/explained/explained-bank-deposit-insurance-programme-and-norms-to-access-funds-7669001/

- Information Technology

- Office Equipment and Supplies

- Cars and Trucks

- Persons

- Books and Authors

- Tutorials

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness